Why are forest hill closing the both banks Barclays n santander is this not fair

Banks closing in Forest Hill

I didn’t realise Barclays was closing too…

I sympathise with anyone who relies on counter services.

However, banks are closing branches all over the country. My parents in Essex now have no branches of any banks in their town too.

Which services do you need to use that cannot be done online?

Cheques are being phased out.

In fact over the next couple of decades, physical cash will start being phased out too. A coffee shop in Brockley stopped accepting physical cash last year (which has improved safety for their staff and avoids the burden of cash handling) - I think others may follow.

To be fair, the only time I ever go into a branch these days is to lodge coins that I have collected over time. When we moved to FH, I had a LARGE amount of coins that I had just put in boxes over the years so I bought a coin counter from Amazon and bagged them all up and took them to barclays in FH over a period of a few weeks. Now I hardly use cash at all… most everything is card or contactless… I do though now have a smaller stash of coins which is much easier to keep on top of.

This is the first I’ve heard the Barclays is closing.

Barclays closing at the end of June. https://www.home.barclays/citizenship/reports-and-publications/branch-closures.html#ForestHill

Sad to see, but thankfully neither are my bank.

I still go in branch about once a month, found it difficult to pay cash in online recently, so prefer to hand it over the counter.

A lot of small businesses still rely on being able to pay cash into a local branch. While cash is no longer king, it is still very relevant at this time.

Hopefully it doesn’t affect any of our local independents.

Sadly it is true. This bank will close the day after the closure of Santander (29th June 2018)

I shall be closing my account.

Not sure how I will pay-in the rare cheques that I get - I guess I’ll have to post them to my bank.

That’s two prominent town centre buildings becoming unoccupied which is a real shame. Any ideas whether there are any tenants lined up? The Barclays building could be a great spot for a new restaurant in a similar way to Mama Dough in Honor Oak (we don’t need another pizza restaurant but i mean in terms of style/location).

Hope whatever takes over the spots doesn’t deal in cash, they will have nowhere to bank it, which would be a little ironic.

I suspect Barclays will become an estate agent, just like the launderette.

So they’re closing Forest Hill, yet Dulwich will continue to have two branches, one in Lordship Lane and the other in Dulwich Village, which doesn’t even have an ATM.

Peckham also has two, while FH will be left with the Post Office for basic banking.

Which might mean Barclays advise on nearby alternatives for cash may be wrong.

Does that tell us something I wonder, or is it just based on the number of customers using each branch, and the climate we are in. Maybe FH really just doesn’t do over counter banking anymore.

Oh an estate agents, yay, that would be good lol. Or maybe the Domino’s that FH so badly needs!

Apparently there is only small percentages of people visiting Santander during certain times. I’m disappointed, but now mostly use the atm for everything now anyway. Can’t say either myself or OH are too keen to do on-line banking. He will be disappointed that Barclays is closing as he was going to transfer there after Santander closed

As for using cards all the time, you have to keep up with every small transaction coming out of the account, & I think the older generation wouldn’t always cope with card only, especially if they are on a small budget. Some independent shops still only take cash as well.

I have to agree, there is still some life left in the banks, for now.

If there were not the need for them, they would be disappearing a lot quicker.

Given the confined space and awkward access of FH Post Office, it being the last counter service financial place is not great.

Wonder why Forest Hill (not forgetting Crofton Park)is losing its banks, as opposed to other local areas.

Maybe customers who need them are just visiting the bigger branches? Who knows

Good point, I am almost certain it would be due to reduced foot fall over other areas. Guess it goes to show the difference in demographics between the local areas.

I went into the Barclays today with my daughter & it is very modern with staff on hand to help. Same really as in the bigger Santanders. So after thinking about it, that’s probably why.

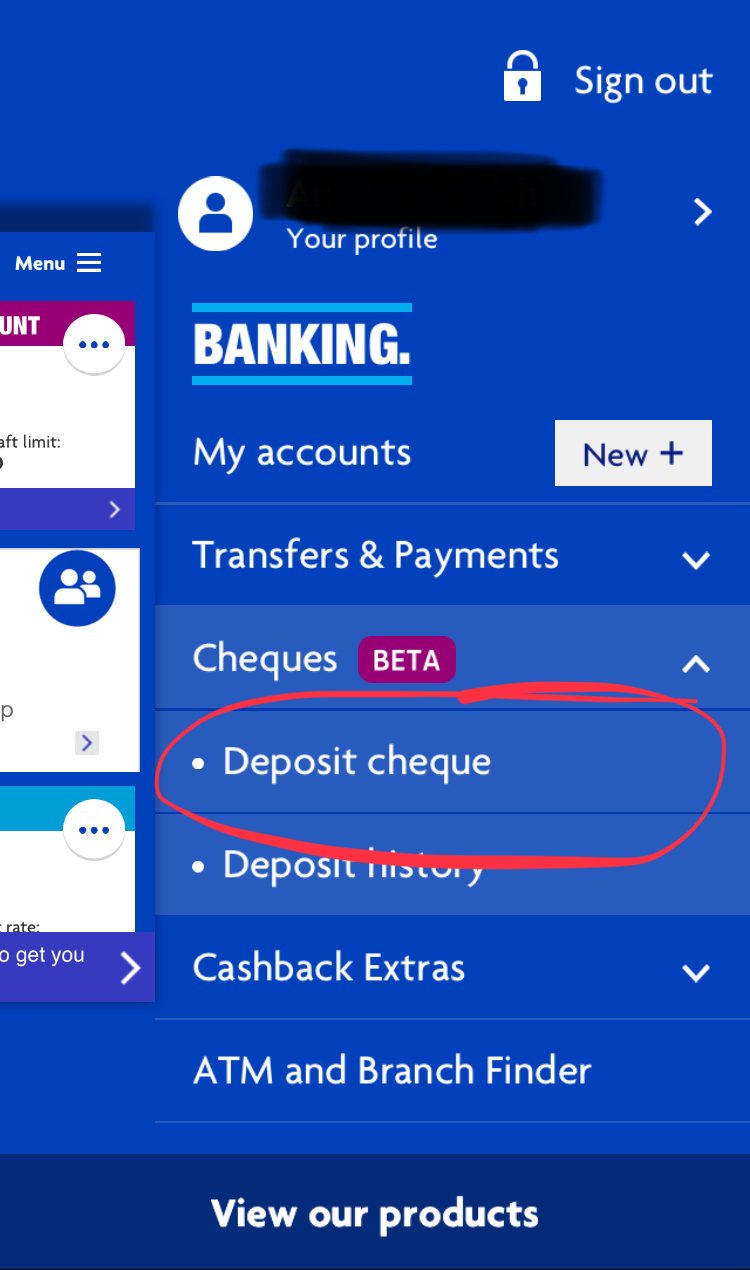

Do Barclays not have an mobile app so you can scan in your cheques that way - I don’y bank with them so might be making this up but I thought they did.

Barclays has always been virtually empty whenever I go in, same with Santander. Probably paying a huge rental with not much profit. More interested to know what’s gonna go in their place…especially as Home Accessories on the way out. Radical changes ahead (bout time really)

Indeed. A mix of independent and chain maybe?

Hoping its not too much more of the same, whatever it is.

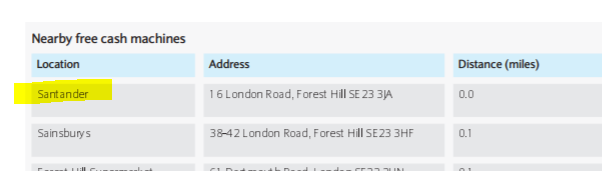

If Santander and Barclays both go - do you think they’ll be taking their cash points with them? I always find them quite ha day for pulling some lunch money in the way to work

There are cash points at Sainsburys as well as the super sloooow dispensers at the station.

I wasn’t aware this was possible! Thanks for the info. Cheques only reason I go into bank branch.

gutted to hear Barclays is closing. I do neither telephone nor online banking so rely on the branch to do stuff other than withdraw cash.

also the staff there are lovely and I hate to think of them losing their jobs.

Remaining free cashpoints off the top of my head.

Sainsbury’s. (1)

Forest Hill Station (2)

There are also two in Dartmouth Road, one at the off licence next to Boots and another further up the road.

Co-Op (1)

Tesco Express/Esso (1)

Cash withdrawals can also be made at FH Post Office inside WHSmith, as well as deposits of which I think Barclays and Santander have signed up for. Cashback of up to £50 is available in Sainsbury’s.

As for online banking, my mother is with Barclays and while being elderly, she uses me to help transfer money between accounts and do bank transfers. However, it does seem unfair for those who rely on that service to either use the PO for basic banking and for more complex issues at Sydenham, Catford or East Dulwich.

Barclays have a pilot scheme for cheque imaging - https://www.barclays.co.uk/ways-to-bank/mobile-banking-services/mobile-cheque-imaging/

Apparently all UK banks will offer this by the end of the year. You learn something new every day.

This pattern certainly heralds a sea change, ultimately the death of cash IMO.

It will still take a while for that to happen. In the meantime, this is bad news for the local area (Crofton Park branch is closing also). It will disproportionately impact the elderly, disabled and small business. Interesting report on this here:

http://researchbriefings.files.parliament.uk/documents/SN00385/SN00385.pdf

The impact on access to finance is troubling. The model of taking a slice of income from small business for processing cards needs to change also. If electronic is the new more efficient form of cash then it should be treated as such. But why would the banks do this if it dents their profit?

The Post Office do have counter serivce arrangements with most of the banks. This is true for sub post offices too. The problem there is that they can be less obliging about it. I have recent experience where a PO counter made a fuss about taking change that was bagged up (and within the allowed limits). At the end of the day, these are small businesses too and are now having to take the brunt of these transactions.

As a small business owner in SE23 this is bad news. I have to pay cheques in from a US client fairly frequently and having the option of walking five minutes to the branch to do it is very convenient particularly as the process of paying it in can take 10 minutes of form filling.

Seems that all the cheque imaging schemes are for sterling cheques only so even that won’t help.

Everything is going! I asked in branch when it was first announced.

I was just about to say that when we lived in the US you could deposit a check (yes thats how they spell it) by taking a photo. Chase had an early iPhone app that allowed this. I wonder why it took so long here…

Typical of our cousins across the pond.

However this spelling aligns better with the old Morecambe and Wise joke about how tight Ernie was with money and his endorsement of how their guests were paid by the BBC - with small checks.

I know I know - don’t write to me - write to the BBC - they broadcast it.

My main concern is how the hell do us shops get small change from notes without any banks.

That’s just from a shop and not a resident point of view, so may be selfish of me to ask.

But it is a concern. For all shops and businesses.

This is what I feared. Any idea of how many others from the FH traders this will affect?

Not selfish of you at all. From my experiences in my own bank in Sydenham, a lot of traders use it still, which is got me wondering.

Hope you all find a solution.

Probably because very few people use cheques. I’ve lived in the UK for almost ten years, and have never written or deposited a cheque.

I wouldn’t be too quick to credit the Americans with advanced payments tech. They’ve only just begun to roll out EMV (chipped) cards and even then most still require the less secure chip ‘n’ signature rather than chip ‘n’ pin. Contactless payment, other than through 3rd party apps like Apple Pay is almost absent.

Yes. That exactly why they rolled out check deposit via image ages ago - because Americans still write checks.

I agree, plus cheque imaging is an additional cheque clearing system in the UK rather than just adding a feature to the existing system. Cheque imaging will clear cheques faster than the existing UK cheque clearing system, which will continue to run in parallel.

Probably triggered (in part) by the acceleration in branch closures throughout the country.

Can’t see cash disappearing - the black economy relies on it …

Press speculation over the weekend is that our government wants to prohibit all cash payments to service providers.

If that means gardeners & cleaners as well as builders - the impact could be very profound and widespread.

I’m already paying most of my ‘small trades’ by direct transfer - gardener, son’s maths tutor amongst others. They actively don’t want cash.

Especially for those of who have the benefit of online banking - but it is far from being universally adopted - or available.

When I was in Crofton Park library yesterday, a woman came in asking if we use the local Barclays as she was very annoyed about it closing. She seemed to be trying to get up a local petition. I mentioned what you had said & she totally agreed . She said if you have got to go to Lewisham to get small change you have to make an appointment!

Got a letter this morning from Thames Water stating we will be getting £30 compensation for the recent outage and that they’ll be sending out CHEQUES in April. Best get them banked before June, eh? Unless your bank is one that accepts photos of cheques (mine doesn’t, yet).

Crikey, that’s good going really, depending on the disruption faced by individuals.

As for the cheques, I guess its the best way for them as a broadscope thing, But ironic all the same.

But couldn’t they just take it off the next bill instead? Would save all the printing/processing and associated costs etc. Seems so last century…

Or transfer it to the account from which they draw down direct debits.

The cynic in me thinks they do this so people may forget or can’t be bothered with the hassle of lodging a cheque. Train companies do this all the time with delay repay schemes.

Anyway, we are getting off topic.

Yes and the schools impacted are getting £2.5k which will be welcome for them. Good PR.

Meanwhile, I notice that there is a major leakage at the junction of Dartmouth Road and South Circular.

We haven’t had a letter yet…will be waiting…sorry off topic  ️

️

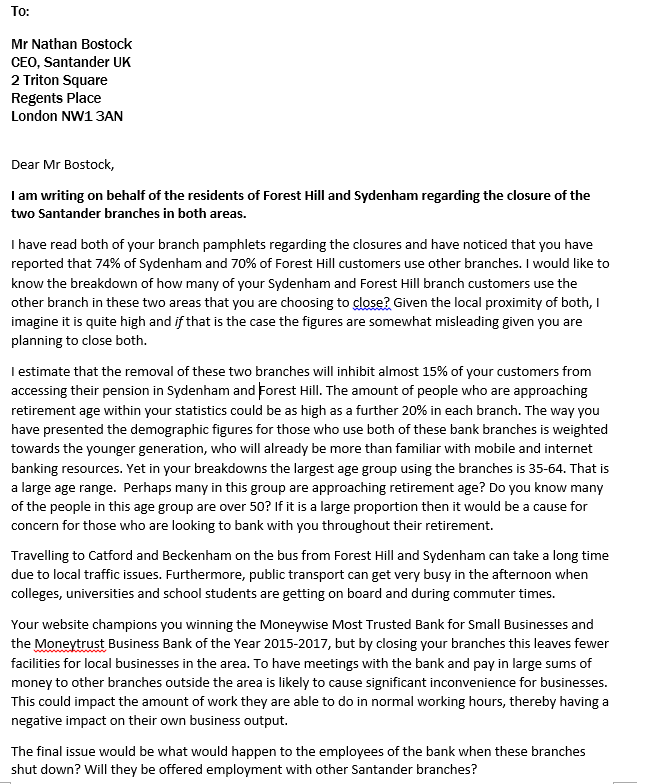

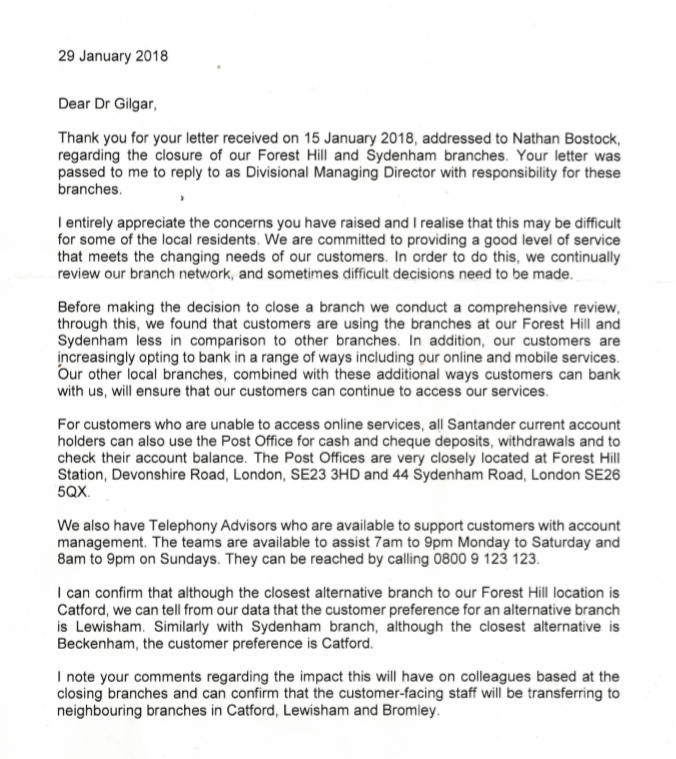

I wrote to Santander in January about concerns over the closures. Their figures justifying the closures seemed suspect to me. They wrote back confirming they were going ahead. Thankfully no one from the Santander branches will lose their job.

I imagine the post office might get busier after June…

I copy my letter and the response from Santander below.

I also started a petition but have only managed to get 38 signatures so far…

I guess the response from Barclays will be similar

I’ve signed.

Thanks for trying Liam.

I’ve signed.

I wonder whether Barclays knew that Santander were closing? Would one of the banks stay if they knew the other was closing, and that they might pick up some of the business of the departing bank? .

I think that is why they are closing the following day - it’s not a coincidence. They can’t risk more people using the branch as that would mean keeping it open. They would far prefer to close the branch and leave Forest Hill without any bank than to see an increase in business to the branch.

I guess the Post Office will see an increase in business, as it will have a monopoly in over-the-counter banking services in Forest Hill.

I’ve signed as well

I know my post won’t be popular but it all kind off sounds like landline phone users rebelling against mobile phones, in five years time we look back and wonder what the fuss was about

I think the statement ‘use it or lose it’ comes to mind, whilst some people do use bank branches a quick survey of friends and relations would indicate that the average is one visit in 4 years to pay in a cheque. The last time a cheque was actually written over 5 years.

I have to agree, my wife has signed the petition but admits she can only remember using the Santander branch once in the last 2 years. We’ve been using internet banking for nearly 20 years.

As long as those who need banking services can get them at the post office and are informed about this fully and in good time I think that is enough.

I don’t expect a petition will be much use in persuading banks into keeping deserted branches open.

If post offices are able to offer the remaining required bank branch services and ideally collection and pick up of various courier parcels too this trend may start saving post offices from closure. Maybe even post office reopenings in more remote parts.

Santander says there is not sufficient footfall at their branch but whenever I go in - not regularly I admit - there are always others in there, often people paying in money or transferring to other accounts,things people like to do in person.

I think this piece from The Guardian gives excellent context:

The fact is that a mix of technology, regulation and competition makes it more difficult to maintain an extensive branch network. Let’s face it, you can get a better savings rate, business loan or foreign exchange from an online rival, leaving bricks and mortar way behind. Additionally, fewer people are using cash. There’s a coffee shop by Brockley station that is card/digital only. I believe by 2026, only 20% of payments will be made by cash. Finally, banks have tougher capital ratios, regulatory burdens and a legacy of upgrading it’s wider branch network and payment systems.

I think any bank starting today would prefer the Metro model I.e. targeted branches in certain locations (around 200 nationwide) rather than thousands across the country that see very few visitors.

The Post Office may not be ideal but it does most services. It’s very much a generational thing, but don’t be surprised when more close.

To add salt into the wounds, Lordship Lane Barclays is closing in June for refurbishment, to become a largely self-service bank, in line with other branches.

At least it is staying open. I wouldn’t mind if Santander were going to do that at Forest Hill. The Post Office is packed as it is! I’m lucky that I’m not working so I don’t mind going to Catford etc, & have no problem with self service. But there are still a lot of people out there that still need a counter service (young & old), who may find it hard to get to Catford or Lewisham. Santander are saying that apart from Catford, Beckenham is the next nearest. I asked them why not Lewisham & I was told that geographically Beckenham is nearer! Cannot see that myself, my son lives in Beckenham & you have to get 2 buses, or a train & a bus!!

According to Apple maps the Beckenham branch is about half a mile closer to me than the Lewisham one. Fine for car drivers, not for anyone wanting to get there via public transport.

They all seem to be doing that. Santander at Catford is being re-furnished or is being refurbished now I think, & Nationwide in Bromley is undergoing a refurbishment at the end of May. Probably others as well that we don’t know about.

Just announced

Barclays has reversed its decision to prevent customers withdrawing money from the Post Office network.

It prompted fury when it announced its debit card holders could deposit money but not withdraw cash from a post office counter from January.

Cancelling that plan, the bank said it recognised the network was “valued by many communities in the UK”.

It had been the only one of 28 banks and building societies not to fully sign up to a Post Office agreement.

“Our decision provoked a great deal of public and private debate. We have listened very carefully to points that have been made to us by ministers in the government, by MPs, and by interested charities and consumer advocates,” said Barclays chief executive Jes Staley.

“Ultimately we have been persuaded to rethink our proposals by the argument that our full participation in the Post Office Banking Framework is crucial at this point to the viability of the Post Office network.”

Not quite correct, there are others. Surprisingly Nationwide does not participate fully in the scheme: withdrawals are permitted but not deposits. Maybe I need to call the Daily Mail.